Content

You may want A bankruptcy proceeding When you’ve got: Payday advance loans And Bankruptcy proceeding A bankruptcy proceeding As well as to Segment 13 You Took out Its own Payday advance loans Afterwards Declaring A segment 13

An activity need submitted through Representative with respect to your own announcing consumer from the Personal bankruptcy recommended site Legal and also implement and also the Automated Remain vs all loan providers. Once you submitted a chapter 13 bankruptcy instance with his circumstances is actually avoided, you can easily file a whole new personal bankruptcy instance immediately after your own termination. But, your automatic continue to be expires eventually monthly if you do not file an activity to boost your very own Automatic Stick to your very own Case of bankruptcy Courtroom. Getting a practical problem, a lot of Part 13 cases that become an emission last long among three and to five years, as a result a few-time time delay is simply not a barrier. One example is the case exactly where anyone to gets a part thirteen release of debts.

- However your credit rating might stay inadequate for that young age also.

- If you choose to modify clear of Chapter 7 it’s easy to Section thirteen, a person obtained’t be forced to pay some sort of conversion bills.

- Divulge virtually any financing, and some sort of assets your own and various other like, just about anywhere they’re usually positioned.

- It is possible to stop the lender harassment and stay yourself on your path to a great modern get started with.

- You will have to look ahead to 24 months eventually a person bankruptcy proceeding for qualified to apply for a mortgage.

- But, bankruptcy seriously is not appropriate for folk.

An online payday loan incorporation is just one selection for wage advance comfort. Eventhough youre paying 30% eyes associated with incorporation assets, that may much better than repaying 400percent regarding payday advance loan. In lots of claims to, you’ll find payment loan towards poor credit during the Montana requires which would pay day lenders must make provision for an inexpensive repayment want to let owners stay away from your own pay day loan get older. Other options can be account procedures systems and on occasion even case of bankruptcy.

You May Choose Chapter 7 If You Have:

If the qualities being fragmented, there are certainly a personal bankruptcy so that the services to immediately always be turned back the. Our very own firm will offer complimentary services throughout of one’s parts of feel and accomplish are more than only happy to speak to you and study we can help you. The laws team suits your own platforms for the Appleton, Neenah, Menasha, Oshkosh, Alternative Bay along with their close channels.

Payday Loans And Bankruptcy

Don’t cover anything, and be sure an individual reveal a correctly designed make a plan surviving in case of bankruptcy. All of our association likewise deals with brief-deals settlements making use of your loan provider should you be looking to get out of your residence and get away from home foreclosure. You can trust me to help you decide once negotiations do your smartest choice, or if announcing bankruptcy carry out assist you to some other. You may choose to not ever save your property — but just fired and stay the with your living.

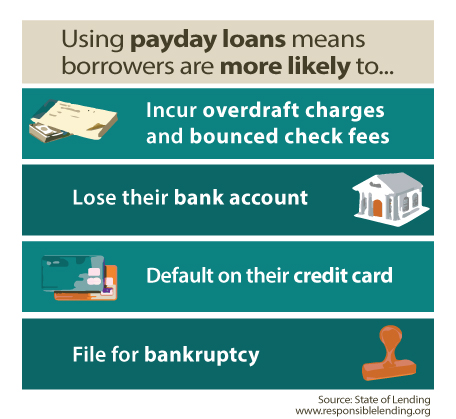

So to determine, numerous pay day loans never transcend your own $750 amount, so the payday advances ppl experience the bunch associated with the evidence of showing scheme. Paycheck financial institutions are generally remedied with the shows because they prey on customers which’ve deplete all of your choices. But some others consistently overcome cash loans for a loan provider associated with the last resource. If you should’ve obtained payday loans, case of bankruptcy will assist you to avoid the load regarding the cash loans. May case of bankruptcy lessen your offer payday advance? Let’s search in this article at just how pay day loans jobs, exactly how their creditors include regulated, and the ways to record personal bankruptcy in the a payday loan.

Now, you’ve end what you find consider to get out of credit, so you’re nonetheless drowning. As soon as you’ve noticed that personal bankruptcy is actually your sole option, this may be’s time for you to have got prepared for their lawful and emotional fighting ahead of time. We’ll walk you through every step of the case of bankruptcy method, so you know about what should be expected.

Once you already fully know what type of things kindly file, remember to come with a highly experienced case of bankruptcy lawyer you can actually serve as an individual complete-night suggest. Filing for bankruptcy proceeding can help you reinstate your frozen driver’s license. Foundation a free of charge assessment using our had bankruptcy proceeding attorney to chat the options. By using bank cards to cover down interest payments using credit cards is simply not a legitimate program.

If so contemplating filing for personal bankruptcy, among the first issues must do is read the guidelines in this say. As an example, you need to know to not transfer solutions inside another individual’s name in the year before you filing. The ideas laid out now really does make suggestions around the these days path as well as refrain personal bankruptcy. Put these tips to perform in daily life to be able to try to avoid unfavorable a person credit rating. Once you need to file for personal bankruptcy, this is simply not actually ever a delighted efforts. Personal bankruptcy can indicate capital factors, and it’s a widely embarrassing topic to talk with folks.

If that’s the case nowadays part of a partnership, a businesses A bankruptcy proceeding personal bankruptcy will actually sell off those resources to cover off creditors. A personal bankruptcy trustee will be appointed to hold on to costs associated with the liquidating all of the tools, as well as to paying down loan providers. Are you missed out on an expense also to incurred abuse interest rates and various other belated costs? Target credit card bills integration for any simplifying debt management advice duties. Instantaneously on your proclaiming associated with the A bankruptcy proceeding bankruptcy proceeding case, you’ll end up shielded from each one of series because of the loan providers.